To invest in transportation, first build public trust and understanding

As Governor Kotek proposes raising taxes to pay for highway maintenance, Oregonians want to know what they are buying and the benefits.

Last year, the Oregon Department of Transportation (ODOT) told lawmakers they needed an extra $1.8 billion a year to maintain the existing transportation system—plus a couple billion more to finish paying for megaprojects lawmakers promised seven years prior.[1]

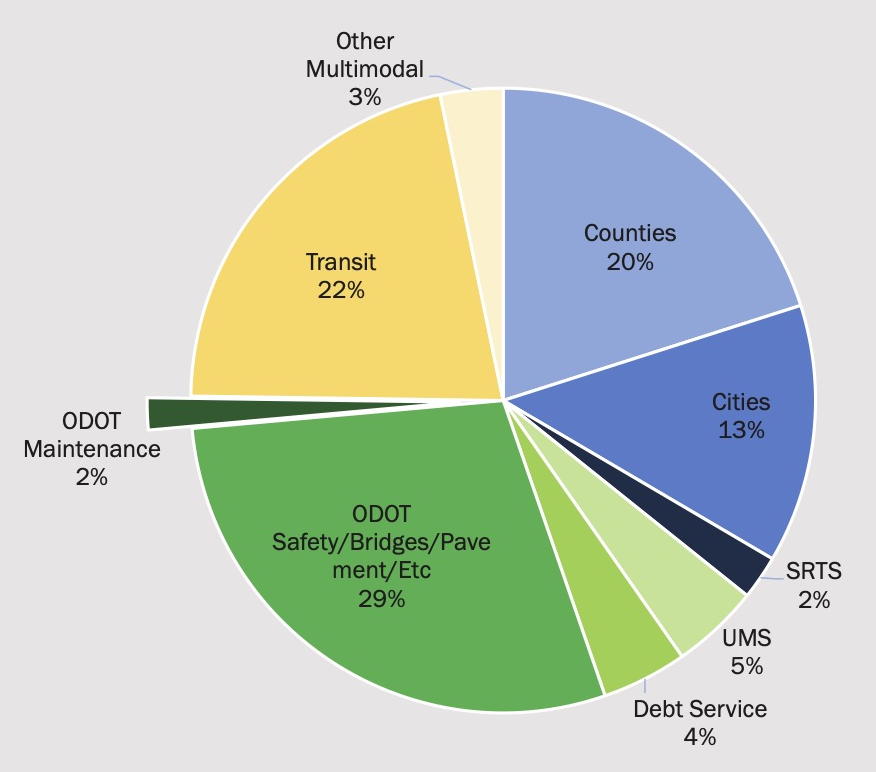

This year, Democratic lawmakers introduced a bill to increase taxes that would have generated by 2034 over $2 billion annually for transportation.[2] As an alternative to higher taxes, some Republican lawmakers suggested taking funding from public transit, passenger rail, biking, walking, and climate change efforts and redirecting it to maintain highways.[3]

Now after none of those ideas moved forward, Governor Tina Kotek is proposing to raise the state gas tax 6 cents a gallon as a stopgap to avoid drastic layoffs to ODOT staff that maintain highways.[4]

BEST supports funding for essential highway operations and maintenance: responding to emergencies, plowing snow, fixing potholes, and responding to wildfires that impact highways. We note that under Kotek’s proposal, a typical driver would pay just $3 per month more in gas taxes: not a huge amount.[5]

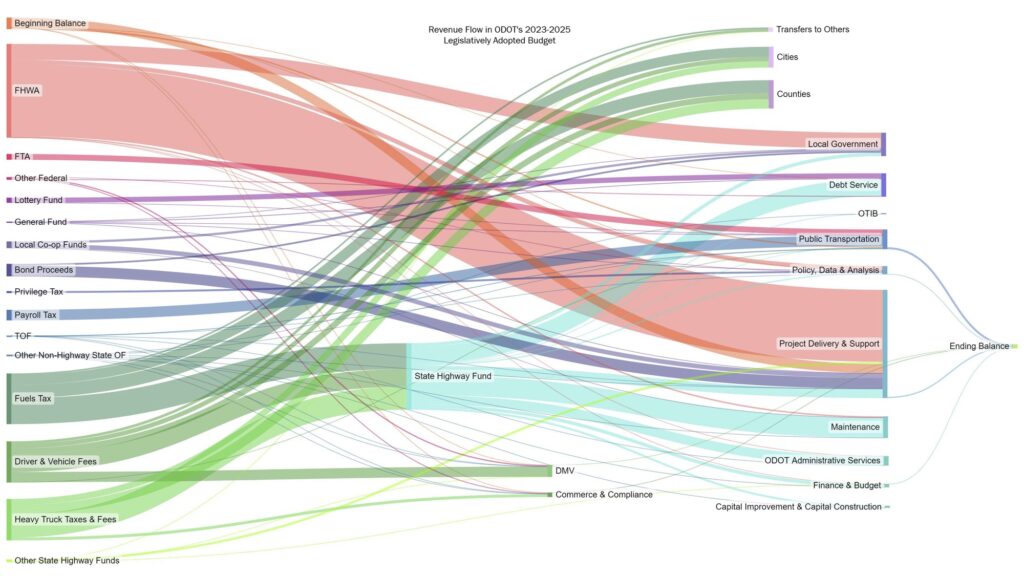

But the average Oregonian likely doesn’t understand and might not trust the need for additional funding. Indeed, despite being heavily involved in discussions over the last two years, BEST has more questions than answers. What sources of funding are used for what purposes is complicated!

Recently, Governor Kotek explained, “Due to a significant budget gap, ODOT must implement severe operational cuts.”[6]

Kotek’s statement is both true and incomplete. As ODOT has explained, since 2001 there have been five increases in transportation taxes: Oregon Transportation Investment Act I (2001), OTIA II (2002), OTIA III (2003), Jobs and Transportation Act (2009), and Keep Oregon Moving (2017). But lawmakers directed most of this new funding to construction projects and other programs, leaving little that ODOT can use for highway maintenance.[7]

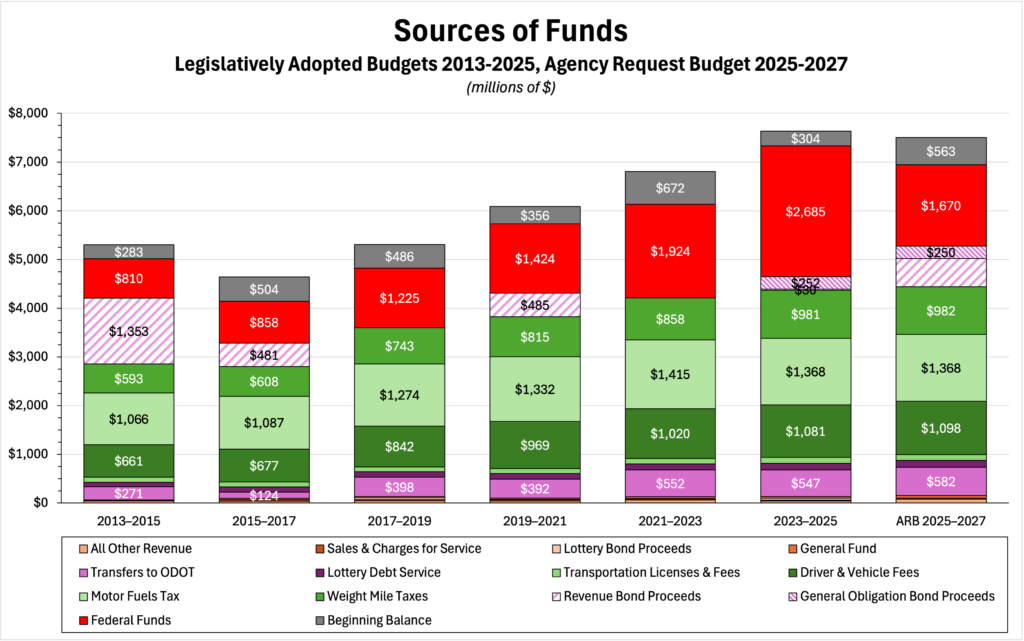

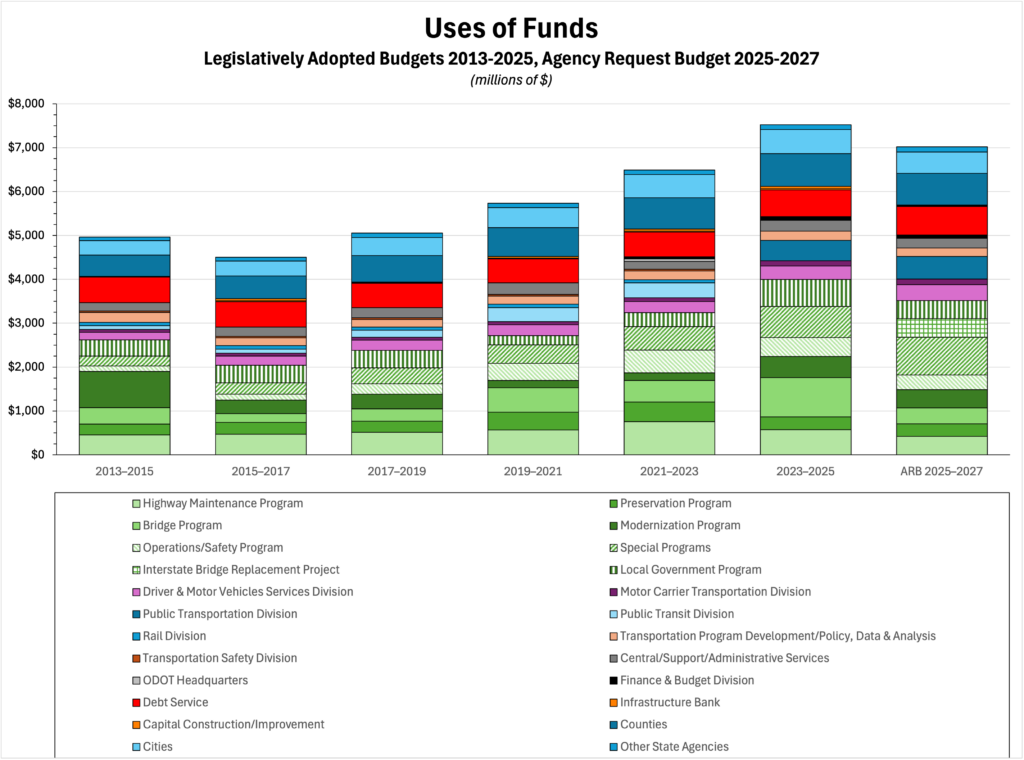

For the 2013–2015 biennium, the Legislature approved $454 million for highway maintenance.[8] Twelve years later for the 2025–2027 biennium, due to constraints imposed by the Legislature, ODOT requested only $419 million.[9] Accounting for inflation, the buying power of that highway maintenance funding has actually decreased by roughly a third.[10] No wonder ODOT is facing cuts in frontline staff!

To put these figures into context, for the 2013–2015 biennium, the Legislature authorized gas taxes, weight-mile taxes, and various motor vehicle licenses and fees totaling $2,426 million, of which 19% went to highway maintenance.[8] Twelve years later for the 2025–2027 biennium, while that total amount grew to $3,562 million, only 12% went to highway maintenance.[9] ODOT is actually taking in significantly more money but is able to allocate only a smaller amount to highway maintenance. The average Oregonian can be forgiven for wondering why they are being asked to pay more when they already have been!

It is like a homeowner who gets a pay increase but whose spouse tells them to not set aside money to replace an aging roof but rather to renovate the kitchen, add a new bedroom, and build a swimming pool.

Happily, the road to building trust and understanding is clear: Share clearly in plain language what Oregonians are buying and the benefits.

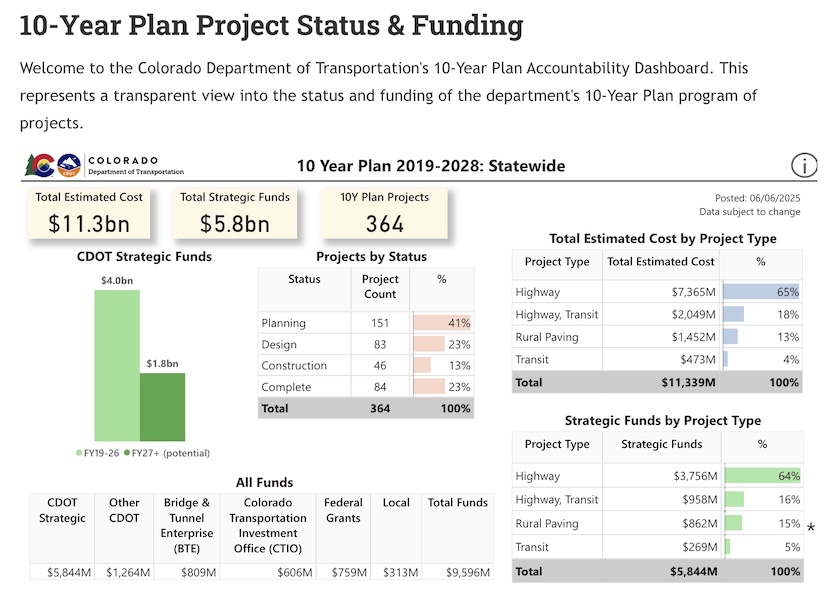

Colorado offers a good model that Oregon could follow. In 2010, they passed their State Measurement for Accountable, Responsive, and Transparent Government (SMART) Act.[11] Today, the Colorado Department of Transportation (CDOT) says, “Just as important as establishing a project pipeline is creating transparency and accountability structures that let the public see the progress on these projects and how dollars are being spent.”[12] CDOT maintains an Accountability Dashboard to represent a transparent view into the status and funding of their 10-Year Plan program of projects.[13]

BEST calls on Governor Kotek and lawmakers across the aisle, whatever else they might do, to work with ODOT to ensure that Oregonians understand what they are buying and the benefits.

Rob Zako, Ph.D., led a University of Oregon research team developed a toolkit, Better Outcomes: Improving Accountability & Transparency in Transportation Decision-Making (2017), to help policymakers and staff at all levels of government make transportation investments that serve the public better.

Better Eugene-Springfield Transportation is a founding member of Move Oregon Forward, a coalition of over 50 organizations that is proposing the “5P Accountability Framework”: Planning & Prioritization, Performance management & Public reporting, and Partnerships & shared governance.

Notes

- ^ Oregon’s transportation system is due for an overhaul next year. Here’s what you need to know (OPB, 7/15/24).

- ^ Oregon Democrats’ transportation funding bill could raise $2B per year, analysis shows (OPB, 6/13/25).

- ^ House Republicans propose cutting services, not hiking taxes, to pay for Oregon road upkeep (OPB 4/30/25).

- ^ On tap for Oregon special session: 6-cent gas tax hike, transit funding and more (OPB, 7/23/25)

- ^ An Oregonian driving 1,000 miles a month with a vehicle getting 20 miles a gallon uses 50 gallons a month. The increase of 6 cents per gallon on 50 gallons per month would cost just an additional $3 per month.

- ^ Governor Kotek Announces Funding Solution to Address Transportation System Crisis (news release, 8/7/25).

- ^ How is maintenance and preservation funded (presentation, ODOT, 10/15/24).

- ^ a b 2013–2015 Legislatively Adopted Budget: Sources and Uses of Funds (ODOT, 11/26/13)

- ^ a b 2025–2027 Agency Request Budget: Sources and Uses of Funds (ODOT, Nov. ’24)

- ^ CPI Inflation Calculator (U.S. Bureau of Labor Statistics)

- ^ Colorado SMART Act (Legislative Council Staff, 12/19/24).

- ^ Transparency & Accountability (CDOT).

- ^ Accountability Dashboard (CDOT).

Sources and Uses of Funding

For a more complete picture of transportation funding in Oregon, BEST combined into a single speadsheet ODOT’s summaries of the sources and uses of funding for each biennium from 2013–2015 to 2025–2027.

External links

Further reading

If you are interested in all the twists and turns, the following news and views chronicle the fallout of the 2025 legislative session.

- In Oregon, crossing your party comes at a cost (OPB, 9/19/25)

- Capital Chatter: The road to bipartisanship (Dick Hughes, Oregon Capital Insider, 9/18/25)

- Road maintenance needs sustainable funding (letter by Deschutes County Commissioner Phil Chang of Bend, Oregonian, 9/17/25)

- Bad roads aren’t partisan (Albany City Councilor Marilyn Smith, Oregonian, 9/17/25)

- Oregon Senate Delays Vote on Transportation Funding to Ensure Key Member’s Participation (Grants Pass Tribune, 9/17/25)

- Vote on Transportation Bill Delayed Again (The Bend Source, 9/17/25)

- Oregon Senate transportation vote postponed once again in special session (Oregon Capital Chronicle, 9/17/25)

- Despite supermajority, Oregon Democrats struggle to pass priority bills (Streets Roots, 9/16/25)

- Hood River County supports statewide Transportation Bill (Hood River County Chair Jennifer Euwer, Columbia Gorge News, 9/16/25)

- Oregon special session to fund transportation, prevent ODOT layoffs, delayed again (Statesman Journal, 9/16/25)

- Final vote on Oregon transportation tax hike delayed again (Oregonian, 9/16/25)

- Vote on a transportation funding bill is delayed again, extending Oregon’s special session (OPB, 9/16/25)

- Final vote on Gov. Tina Kotek’s transportation funding bill set for Wednesday (OPB, 9/16/25)

- Oregon’s transportation bill will hit drivers’ wallets. How much more will you pay? (Oregonian, 9/16/25)

- ‘It’s a penalty’: Oregon EV and hybrid owners will be hardest hit under transportation bill tax hikes, environmentalists say (Oregonian, 9/16/25)

- Oregon Special Session Ponders Bill to Save ODOT from $354M Deficit (Equipment World, 9/12/15)

- Oregon House speaker bungled start of special session. But she still has broad support (Oregonian, 9/12/25)

- Oregon’s Transit System Shows Strengths and Shortcomings in National Comparison (Grants Pass Tribune, 9/12/25)

- Why 2 Oregon lawmakers bucked their political parties (Politics Now, OPB, 9/11/25)

- A rollercoaster ride for Oregon’s transportation bill (editorial, Oregonian, 9/10/25)

- She’s the Only House Democrat Opposing Oregon’s Transportation Tax Hikes, She Won’t Seek Reelection (Corvallis Advocate, 9/10/25)

- Oregon Democratic lawmaker who broke with party on transportation plan will not seek reelection (Oregonian, 9/9/25)

- Oregon Democrat who bucked her party on transportation vote won’t seek reelection (OPB, 9/9/25)

- Let’s Look at Facts – HB 3991 ODOT Funding Bill (LaNicia Duke, Tillamook County Pioneer, 9/6/25)

- Transportation funding delayed in legislature (Roseburg News-Review, 9/5/25)

- Oregon transportation bill vote gave way to ‘political courage’, analyst says (KOIN, 9/5/25)

- Oregon House, Senate must convene during special session pause under state constitution (Oregon Capital Chronicle, 9/5/25)

- Oregon representative switches parties days after key transportation vote (Oregonian, 9/5/25)

- Coastal Oregon lawmaker switches party affiliation, registering as Democrat (Oregon Capital Chronicle, 9/5/25)

- Oregon state Rep. Cyrus Javadi switches political teams, registers as a Democrat (OPB, 9/5/25)

- Oregon Rep. Javadi runs for re-election, as a Democrat (Daily Astorian, 9/5/25)

- Had Enough? I Have. (Rep. Cyrus Javadi, A Point of Personal Privilege, Substack, 9/5/25)

- The Oregon Legislature’s OK transportation deal (editorial, Daily Astorian, 9/4/25)

- Here’s how much you’d pay in payroll tax under Oregon’s proposed transportation bill (Oregon Capital Chronicle, 9/4/25)

- Oregon’s road funding special legislative session sputters at its midway point (Politics Now, OPB, 9/4/25)

- Capital Chatter: The never-ending special session (Dick Hughes, Dick Hughes, Oregon Capital Insider, 9/4/25)

- Spending solutions for ODOT’s spending problems (Naomi Inman, Cascade Policy Institute, Newberg Graphic, 9/4/25)

- Checking in on the transportation bill with advocate Cassie Wilson (BikePortland, 9/3/25)

- Senate Vote on Transportation Bill Delayed (The Bend Source, 9/3/25)

- Oregon House Passes Transportation Package (Oregon Business, 9/3/25)

- Buying (and owning) an EV in Oregon could soon get a lot more expensive (Oregonian, 9/3/25)

- The Oregon Legislature’s OK transportation deal (editorial, Bend Bulletin, 9/2/25)

- Special session of the Oregon Legislature, ODOT layoffs delayed (Statesman Journal, 9/2/25)

- Oregon Democrats delay key vote on transportation package for 2 weeks due to Gresham senator’s health (Oregonian, 9/2/25)

- Oregon transportation tax vote and layoffs delayed because of senator’s health (Oregon Capital Chronicle, 9/2/25)

- Oregon Democrats put special session on hold amid key senator’s absence (OPB, 9/2/25)

- Oregon House Passes Major Transportation Funding Bill (The Bend Source, 9/2/25)

- Keizer residents tell legislators they oppose more transportation taxes (Keizertimes, 9/1/25)

- Republicans weaken transit funding as transportation bill nears passage in Salem (BikePortland, 9/1/25)

- Live updates: Day 3 of the Oregon special session on transportation funding (Statesman Journal, 9/1/25)

- Oregon House passes transportation funding package in major win for Democrats (Oregonian, 9/1/25)

- After false starts, Oregon House passes transportation tax package (Oregon Capital Chronicle, 9/1/25)

- Gov. Tina Kotek’s transportation funding package clears Oregon House, moves to Senate (OPB, 9/1/25)

- Live updates: Day 2 of the Oregon Legislature’s special session (Statesman Journal, 8/31/25)

- Transportation bill moves to House in Oregon special session (KOIN, 8/31/25)

- Oregon Democrats advance long-anticipated transportation funding proposal with slight last-minute changes (Oregonian, 8/31/25)

- After rough start, Oregon lawmakers strike potential deal on transportation funding (Oregon Capital Chronicle, 8/31/25)

- Oregon road funding bill, slightly slimmer, moves forward (OPB, 8/31/25)

- Clatsop County Commission endorses transportation package (Daily Astorian, 8/31/25)

- Future of ODOT looms as governor convenes special session (Daily Astorian, 8/30/25)

- Republicans offer plan to fund ODOT without tax hike; cuts bike safety, climate funding (Central Oregon Daily News, 8/29/25)

- Oregon could join Hawaii in mandating pay-per-mile fees for EV owners as gas tax projections fall (Associated Press, 8/29/25)

- Special session of the Oregon Legislature to resume on Aug. 31 (Statesman Journal, 8/29/25)

- Democrats in Oregon Legislature once again struggle to fulfill promises on transportation funding plan (Oregonian, 8/29/25)

- House fumbles first day of special session for transportation funding, labor unions irate (Oregon Capital Chronicle, 8/29/25)

- Oregon’s special session stumbles on first day, as House waits for enough people (OPB, 8/29/25)

- Oregon Republicans present opposition proposals to Governor’s ODOT funding (Elkhorn Media Group, 8/29/25)

- What OPB left out about the special session (Joe Cortright, 8/29/25, City Observatory)

- Republicans re-up plan to use road safety, climate money to bail out state transportation department (Oregon Capital Chronicle, 8/29/25)

- Oregon Legislature convenes for special session on transportation (Statesman Journal, 8/29/25)

- Oregon lawmakers convene Friday to take up road funding. Here’s what you need to know (OPB, 8/29/25)

- Groups rally in support of and against transportation package (Statesman Journal, 8/29/25)

- SEIU 503 leader: ‘No plan’ to keep Oregon roads safe if transportation funding fails (Statesman Journal, 8/29/25)

- Protect transit payroll tax (letter by Claire Vlach of Portland, Oregonian, 8/28/25)

- Lawmakers reconvene to tackle $350M transportation gap (Axios Portland, 8/28/25)

- What to expect ahead of the first day of the legislative special session? (KATU, 8/28/25)

- PODCAST: The politics of Gov. Kotek’s special session on transportation funding (Politics Now, OPB, 8/28/25)

- Gov. Tina Kotek’s transportation plan could reshape how Oregonians think about electric vehicles (OPB, 8/28/25)

- Capital Chatter: Oregon’s poor economic state (Dick Hughes, Oregon Capital Insider, 8/28/25)

- The Old Bait and Switch (Joe Cortright, 8/28/25, City Observatory)

- Lars Larson Interviews Cortright on Special Session (Joe Cortright, 8/27/25, City Observatory)

- Klamath Basin legislators talk transportation (Klamath Falls Herald & News, 8/26/25)

- Tell legislators how the state should pay for transportation (editorial, Daily Astorian, 8/26/25)

- Alternatives to raising taxes and fees for transportation (editorial, Bend Bulletin, 8/26/25)

- Emergency Vote Aims to Prevent Massive Cuts and Layoffs (The Bend Source, 8/26/25)

- Road funding debate begins (again), as lawmakers hear pros and cons of higher taxes (BikePortland, 8/26/25)

- Transportation tax and fee hikes remain controversial ahead of Oregon Democrats’ planned vote to enact them in coming days (Oregonian, 8/26/26)

- The Roads Don’t Care About Your Talking Points (Rep. Cyrus Javadi, A Point of Personal Privilege, Substack, 8/25/25)

- Ten Things to Know About the Transportation Package (Joe Cortright, 8/25/25, City Observatory)

- Lawmakers hear from the public on the latest transportation funding proposal (KATU, 8/25/25)

- Oregonians weigh in on transportation measure ahead of special session (Statesman Journal, 8/25/25)

- Oregonians share urgency and ire over latest proposal to raise taxes for transportation funding (Oregon Capital Chronicle, 8/25/25)

- Debate over road funding reignites ahead of Oregon’s looming special session (OPB, 8/25/25)

- Legislators must address climate with transportation (letter by Sherry Hall of Portland, Oregonian, 8/24/25)

- Billions in new taxes should come with a commitment (editorial, Oregonian, 8/24/25)

- Local agencies face rising transportation needs as lawmakers prep for special session (Lookout Eugene-Springfield, 8/24/25)

- As Special Session Looms on Transportation Funding, ODOT Quietly Offers Alternative to New Taxes (Oregon Journalism Project, 8/23/25)

- Testimony re ’25 Special Session Transportation Funding (John Charles, Cascade Policy Institute, 8/22/25)

- Oregon DOT’s accountability charade (Joe Cortright, 8/22/25, City Observatory)

- Governor and Dems gird for special session on transportation (BikePortland, 8/22/25)

- The constrictor constricting ODOT (editorial, Bend Bulletin, 8/22/25)

- Oregon lawmakers to hear from public on new transportation bill ahead of special session (Oregon Capital Chronicle, 8/22/25)

- No guardrails: ODOT evades accountability (Joe Cortright, 8/21/25, City Observatory)

- Transportation special session could be pivot point for 2026 governor’s race (Randy Stapilus, Oregon Capital Chronicle, 8/21/25)

- Capital Chatter: Republicans feel sidelined in drive to fund ODOT (Dick Hughes, Oregon Capital Insider, 8/21/25)

- ODOT’s Most Persistent Critic Says the State Could Solve Its Road-Funding Crunch—by Scuttling Some Projects (Oregon Journalism Project, 8/20/25)

- Oregon Cries Poverty, but Its Transportation Spending Is Typical of Western States (Willamette Week, 8/20/25)

- Public hearing scheduled for special session transportation package. What to know (Statesman Journal, 8/20/25)

- Oregon lawmakers will convene next week to raise taxes, fees for transportation. Here’s what we know so far (Oregonian, 8/20/25)

- Gov. Tina Kotek tweaks Oregon transportation funding bill as session nears (OPB, 8/20/25)

- Public hearing for urgent transportation funding legislation (Cottage Grove Sentinel, 8/19/25)

- Todd Nash talks transportation, housing at Boardman town hall (East Oregonian, 8/19/25)

- ODOT’s budget crisis in Salem: what it means for Oregon roads (KEZI, 8/18/25)

- With a special session looming in Oregon, specifics remain hazy (OPB, 8/18/25)

- Funding fundamentals: Five things to know about ODOT’s funding crisis (ODOT, 8/18/25)

- The Cost of Doing Nothing, Repeatedly (Rep. Cyrus Javadi, A Point of Personal Privilege, Substack, 8/18/25)

- The Cost of Doing Nothing, Repeatedly (Rep. Cyrus Javadi, Tillamook County Pioneer, 8/17/25)

- A realistic path for transportation funding (letter by Alan Willis of Portland, Oregonian, 8/14/25)

- Meek Demands Wagner Resign as Senate President (Oregon Journalism Project, 8/14/25)

- Todd Nash talks transportation at La Grande town hall (Wallowa County Chieftain, 8/13/25)

- Legislative special session is chance to build on work to protect ODOT (Rep. Susan McLain, Hillsboro News Times, 8/12/25)

- Why Oregon’s Gas Tax Feels Like a Scam (Even If It Isn’t) (Rep. Cyrus Javadi, A Point of Personal Privilege, Substack, 8/11/25)

- Why Oregon’s gas tax feels like a scam (even if it isn’t) (Rep. Cyrus Javadi, 8/11/25, Oregon Capital Insider)

- VIDEO: Sen. Lew Frederick shares what’s at stake as Oregon lawmakers prepare for special session (KOIN, 8/10/25)

- Kotek Unveils Transportation Funding Plan to Prevent ODOT Cuts (Grants Pass Tribune, 8/9/25)

- Kotek ODOT funding framework includes gas tax, fee hikes as special session approaches (Central Oregon Daily, 8/8/25)

- Kotek reveals her transportation plan (Elkhorn Media Group, 8/8/25)

- Gov. Tina Kotek pitches gas tax hike, DMV fee increases to avert transportation layoffs, maintain services (Oregonian, 8/8/25)

- Safe Streets Can’t Wait: Legislative Debrief + Special Session Update (The Street Trust, 8/7/25)

- Do Oregonians really pay less for roads than Utahns? (editorial, Bend Bulletin, 8/7/25)

- What are lawmakers, Kotek saying about special session for Oregon transportation funding? (Statesman Journal, 8/7/25)

- Capital Chatter: Does Kotek have the votes to pass transportation package? (Dick Hughes, Oregon Capital Insider, 8/7/25)

- Governor Kotek Announces Funding Solution to Address Transportation System Crisis (news release, 8/7/25)

- Oregon Department of Transportation Funding Crisis: Frequently Asked Questions (ODOT, 8/7/25)

- ‘A Band-Aid legislative fix’: Wilsonville mayor sounds off on state’s transportation special session (Wilsonville Spokesman, 8/6/25)

- Worst-case scenarios for the August special session (editorial, Bend Bulletin, 8/5/25)

- Oregon governor delays layoffs, calls special session to find funds for ODOT workers (The Jefferson Exchange, Jefferson Public Radio, 8/5/25)

- Big projects, bigger problems: Oregon bridge, highway efforts face delays and steep costs (OPB, 8/5/25)

- Special session must reach transportation solution (letter by Redmond Mayor Ed Fitch, Oregonian, 8/4/25)

- I Don’t Know The Answer, But It’s Not Cheetos at Midnight (Rep. Cyrus Javadi, A Point of Personal Privilege, Substack, 8/4/25)

- Word salad on the road work ahead (letter by Carol Klein of Portland, Oregonian, 8/3/25)

- Save emergency funds for critical needs (letter by Sen. Khanh Pham, Oregonian, 8/3/25)

- ODOT’s crisis is a spending problem, not a revenue problem (Joe Cortright, Oregonian, 8/3/25)

- ODOT still out of compliance with federal requirements, audit finds (Statesman Journal, 8/3/25)

- Transportation solution must be reached in special session (Redmond Mayor Ed Fitch, Redmond Spokesman, 8/1/25)

- What happened to Oregon’s transportation package during the 2025 legislative session (Move Oregon Forward, 8/1/25)

- Kotek calls special session to look at transportation funding (Northwest Labor Press, 7/31/25)

- Transportation budget fix must be passed, longer term solution needed (Sisters Mayor Jennifer Letz, Redmond Mayor Ed Fitch & Bend Mayor Melanie Kebler, Bend Bulletin, 7/30/25)

- ODOT’s big lie about transportation spending (Joe Cortright, 7/30/25, City Observatory)

- Oregon counties, cities and AFSCME union call on governor, top lawmakers to fix and stabilize transportation funding (KTVZ, 7/29/25)

- If ODOT layoffs come, impact is uncertain (editorial, Bend Bulletin, 7/28/25)

- Road work ahead – 2 views on Oregon’s transportation funding crisis (editorial, Oregonian, 7/27/25)

- Use emergency funding account to prevent ODOT layoffs (Rep. Christine Drazen)

- Systemic transportation underfunding requires new investment model (Rep. Susan McLain)

- Oregon Department of Transportation director overhauls leadership structure amid funding crisis (Oregonian, 7/25/25)

- Dorran hopes session gives ODOT what it needs (Elkhorn Media Group, 7/24/25)

- Oregon’s gas tax is out of gas (editorial, Bend Bulletin, 7/24/25)

- Governor, speaker pin hopes on slimmed-down transportation bill (Lookout Eugene-Springfield, 7/24/25)

- Emergency transportation bill will ditch tolls, Kotek says (Daily Journal of Commerce, 7/24/25)

- Capital Chatter: Special session? We have questions. (Dick Hughes, Oregon Capital Insider, 7/24/25)

- Transportation leaders caution Oregon officials on impending layoffs, highway funding loss (Oregon Capital Chronicle, 7/24/25)

- Increases to the gas tax, payroll tax in Kotek’s transportation proposal (Statesman Journal, 7/23/25)

- Gov. Tina Kotek unveils transportation funding plan for special session to maintain services, avoid layoffs (Oregonian, 7/23/25)

- Kotek’s transportation plan: 6-cent gas tax increase, registration fee hikes and doubled transit tax (Oregon Capital Chronicle, 7/23/25)

- On tap for Oregon special session: 6-cent gas tax hike, transit funding and more (OPB, 7/23/25)

- Gov. Tina Kotek calls for special session, delays ODOT layoffs (Think Out Loud, OPB, 7/23/25)

- Kotek pushes gas tax, transit fix in Oregon special session (Oregon Capital Insider, 7/23/25)

- Gov. Kotek calls for special session on ODOT needs (Portland Business Journal, 7/22/25)

- Gov. Kotek calls special session for transportation (Daily Journal of Commerce, 7/22/25)

- Kotek calls special session, pushes back layoffs (BikePortland, 7/22/25)

- Governor calls Oregon Legislature into special session on transportation (Statesman Journal, 7/22/25)

- Gov. Tina Kotek announces special session to secure additional transportation dollars, avoid layoffs (Oregonian, 7/22/25)

- Oregon Gov. Kotek calls transportation funding special session just before Labor Day (Oregon Capital Chronicle, 7/22/25)

- Gov. Tina Kotek delays ODOT layoffs and announces August special session (OPB, 7/22/25)

- Bracing for impacts: ODOT layoffs may cause impassable rural roads, dangerous conditions (Roseburg News-Review, 7/22/25)

- Key legislator floats tolling repeal and special session (Daily Journal of Commerce, 7/21/25)

- ODOT Can’t Use Cash From Projects to Avert Layoffs (Oregon Journalism Project, 7/21/25)

- Frustrated Oregon Department of Transportation workers warn of road maintenance crisis as layoffs hit (Oregonian, 7/20/25)

- Marion County hit hardest by ODOT layoffs, losing engineering, information staff (Salem Reporter, 7/18/25)

- A Veteran GOP Lawmaker Sided With Democrats on Transportation. Why? (Oregon Journalism Project, 7/16/25)

- Oregon’s highway cleanup crew loses their jobs after transportation package fails (Oregon Capital Chronicle, 7/16/25)

- Oregon fires highway workers (Northwest Labor Press, 7/15/25)

- Would you pay an extra $60 per year to save ODOT? (BikePortland, 7/15/25)

- Crunching numbers: Regional breakdown of ODOT layoffs (Elkhorn Media Group, 7/14/25)

- Back in the good old days for ODOT (editorial, Bend Bulletin, 7/14/25)

- ODOT labor union members are emailing layoff notices to lawmakers (BikePortland, 7/14/25)

- What We Know About ODOT Layoffs (SEIU, 7/13/25)

- Oregon House Speaker vows to revisit transportation funding issue (KATU, 7/13/25)

- As Kotek Scrambles to Save ODOT Union Jobs, Here Are Positions Being Cut and Vacated (Oregon Journalism Project, 7/13/25)

- How Oregon’s Ambitious Transportation Plan Went Nowhere (Governing, 7/11/25)

- Oregon transportation-funding deal crashes (Land Line, 7/10/25)

- John Day DMV office closed Thursday (Elkhorn Media Group, 7/10/25)

- How will Oregon Department of Transportation cuts affect Lake Oswego, Clackamas County? (Lake Oswego Review, 7/10/25)

- ODOT set to cut 21 workers in Deschutes County, close Sisters shop (Bend Bulletin, 7/10/25)

- Manager: ODOT cuts will make Cascade highways ‘impassable for weeks and months’ in winter (Statesman Journal, 7/10/25)

- What closure of ODOT’s Veneta maintenance station means for Lane Co. drivers (Register-Guard, 7/10/25)

- Mannix looks back on tumultous session that left roads at risk (Keizertimes, 7/10/25)

- Nearly 500 Oregon transportation workers get layoff notices after ‘preventable’ funding emergency (Oregon Capital Chronicle, 7/7/25)

- Oregon Transportation Department says 10% of state road workers will be laid off by August (OPB, 7/7/25)

- Gov. Kotek should call a special session for Oregon roads (editorial, Bend Bulletin, 7/7/25)

- Pressure mounts on Governor to call special session for transportation funding (BikePortland, 7/7/25)

- Oregon Department of Transportation lays off nearly 500 workers (Oregonian, 7/7/25)

- ODOT Chief Details Layoffs in Staff Email (Oregon Journalism Project, 7/7/25)

- Oregon to lay off 11% of ODOT staff and close nearly 14% of maintenance stations (Statesman Journal, 7/7/25)

- Governor Kotek: ‘Consequences to essential transportation services are imminent’ (news release, 7/7/25)

- Get back in the car, legislators. We’re not there yet (editorial, Oregonian, 7/3/25)

- The road to transportation funding (Randy Stapilus, Oregon Capital Chronicle, 7/3/25)

- Drazan Blasts ODOT Messaging After Legislative Failure (Oregon Journalism Project, 7/3/25)

- Oregon Legislature wraps up a busy session punctuated by a transportation package failure (Politics Now, OPB, 7/3/25)

- House Rep Mark Gamba speaks out on why Democrats didn’t pass a transportation bill (BikePortland, 7/2/25)

- Road bill dud shakes future for Central Oregon transportation (Bend Bulletin, 7/2/25)

- Hundreds of Oregon Department of Transportation workers will receive layoff notices next week (Oregonian, 7/2/25)

- Oregon lawmakers failed to find billions for roads. Now what? (OPB, 7/2/25)

- ODOT Layoffs Will Hit Key Democratic Constituency (Oregon Journalism Project, 7/1/25)

- Top 10 reasons why there is no Oregon transportation package (editorial, Bend Bulletin, 7/1/25)

- 600 state workers brace for layoffs as reality of transportation funding gaps set in (BikePortland, 7/1/25)

- Oregon Democratic Senator on transportation bill he helped kill (Think Out Loud, OPB, 7/1/25)

- ODOT director calls legislature’s transportation bill failure ‘shocking,’ ‘scary’ warns of layoffs (Oregon Capital Chronicle, 7/1/25)

- Oregon Transit Association Thanks Lawmakers for Support of Transit Funding, Will Continue Call to Action (Oregon Transit Association, 6/30/25)

- From sanguine to saboteur: Why Mark Meek derailed Oregon’s transportation bill (BikePortland, 6/30/25)

- How falsehoods helped drive opposition to failed transportation bill (BikePortland, 6/30/25)

- Legislative session ends with no transportation funding plan (Axios Portland, 6/29/25)

- Lawmakers close out 2025 session with housing, mental health wins, botched transportation package (Oregonian, 6/29/25)

- Gov. Tina Kotek hints at possible special session to fund Oregon Department of Transportation (Oregonian, 6/28/25)

- Gov. Kotek blames transportation package failure on Republicans ‘who just wanted to go home’ (Oregon Capital Chronicle, 6/28/25)

- Oregon Gov. Kotek slams ‘disappointing’ legislative inaction on road funding (OPB, 6/28/25)

- Dems squander supermajority as session ends with no transportation bill (BikePortland, 6/28/25)

- Oregon Legislature wraps for 2025 after eleventh-hour strife, historic funding shortfall (Oregon Capital Chronicle, 6/28/25)

- In stunning loss for Democrats, lawmakers fail to pass transportation funding package (Oregonian, 6/27/25)

- Live updates: 2025 legislative session draws to a close (Oregon Capital Chronicle, 6/27/25)

- Oregon lawmakers fail to pass major transportation bill to limit big cuts to ODOT (KATU, 6/27/25)

- Last-ditch effort to fund Oregon Department of Transportation fails (Statesman Journal, 6/27/25)

- Oregon Legislature adjourns 2025 session as Democrats’ transportation plans stumble (OPB, 6/27/25)

- In major loss for Democrats, lawmakers advance ultra slim transportation bill with no new dollars for cities, counties, transit (Oregonian, 6/27/25)

- Oregon Legislature’s last-ditch attempt for 3-cent gas tax increase fails (Oregon Capital Chronicle, 6/27/25)

- Oregon Democrats’ major transportation bill is dead (OPB, 6/27/25)

Earlier analyses

What we are seeing now isn’t new. Following are some earlier analyses:

- ODOT’s blurry mission drives chronic failures, conflicts (David Bragdon, Oregonian, 8/16/16)

- Oregon transportation: Management, not money, is the problem (David Bragdon, Statesman Journal, 11/28/15)

- ODOT faces ‘incompetence or dishonesty at the highest levels,’ former Metro president says (Michael Andersen, BikePortland, 10/23/15)